Patna, BIHAR :

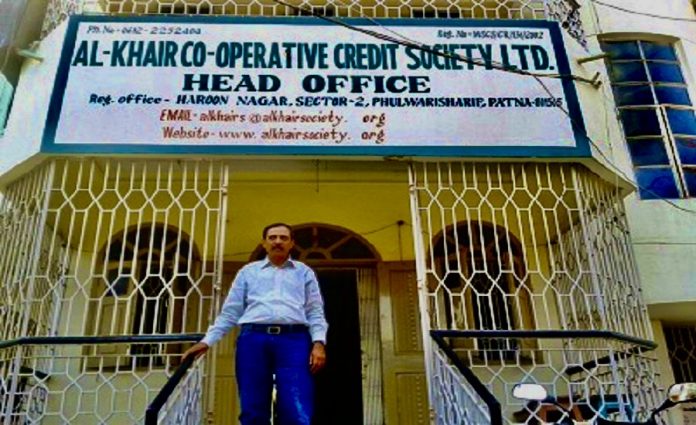

Headquartered in a small building in the state capital Patna, Al-Khair Co-operative Credit Society, with thirteen branches in four states, has transformed lives by loaning money to low-income groups at zero interest rate.

Patna (Bihar) :

For 18 years, 51-year-old Kamala Devi used to sell vegetables at her small shop in Patna, Bihar, to support her family. The business wasn’t doing well and when in need of cash she would borrow money from a local lender at a 20 percent interest rate per month. Paying back this money at this interest rate was an extra burden. She found a way out when she came to know about the Al-Khair Co-operative Credit Society, a registered society based in Patna that loans money to low-income groups at zero interest rate.

In 2012, she borrowed Rs 10,000 from Al-Khair with zero interest and a one-time nominal service charge. With this money, which she had to repay by easy installments of Rs 50 per day, Devi started selling readymade garments at her shop. Her business improved. She paid back the loan amount in one year. Happy with the result, she took two more loans to expand her business.

“I am planning to borrow Rs five lakh from Al-Khair after repaying a loan of three lakh twice in the last three years. My goal is to further expand my business with the help of my elder son,” Devi told TwoCircles.net.

Besides lending her money to help her business, Al-Khair also loaned her money to buy a laptop for her younger son, who works in a private company.

“My family is settled now and our days of hardships are over,” she said.

Devi is one among 29,000 members of Al-Khair Co-operative Credit Society, a registered body under the Multi-State Co-operative Society (MSCS) Act 2002.

The society has 13 branches across Bihar, Jharkhand, Uttar Pradesh and New Delhi. Its beneficiaries include vegetable vendors, ready-made garments shopkeepers, medicine shop owners and Dhaba (eatery) owners etc.

Launched in 2002 by Arshad Ajmal (then chairman of Al-Khair Charitable Trust), Dr Badurl Hoda, Syed Shamim Rizvi and a few others, it employs 125 people as its staff. The need for such a society was felt after a detailed survey in 2001 conducted by S.B. Sinha, a Harvard University expert, revealed that “only 10% of people who were in need of loans had access to commercial banks.”

In order to become a member, one is required to buy at least 10 shares of Rs 10 each.

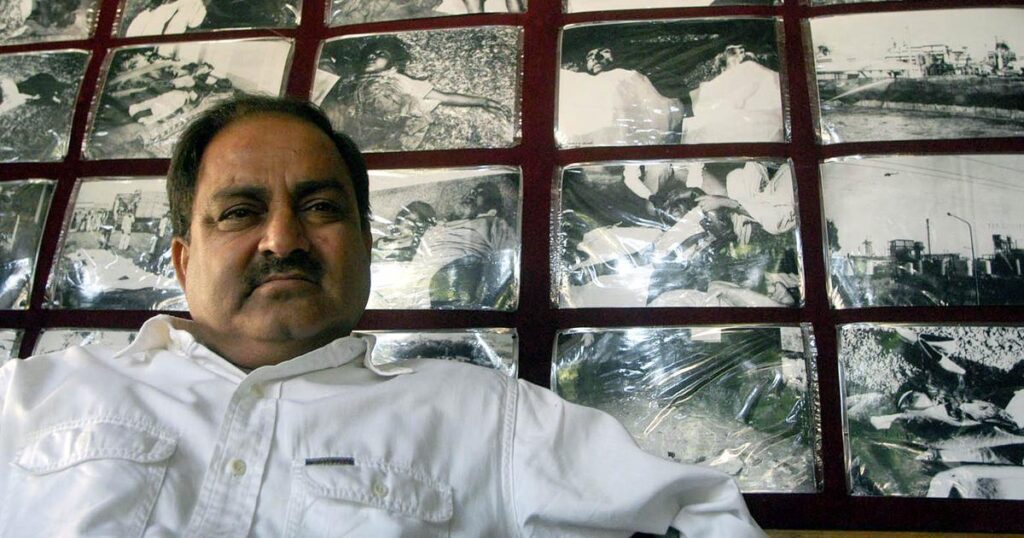

Managing Director of Al-Khair Naiyer Fatmi told TwoCircles.net that “Al-Khair has disbursed loans of Rs 113 crores since its inception.”

Fatmi said that they levy a one-time service charge ranging from 3.5 to 8.5 per cent.

Helping hand to low-income women during pandemic

Nearly 35 percent of Al-Khair’s members are women. In 2012, Al-Khair started a branch in Mahendru, Patna that is run entirely by women. 42-year-old Shama Parween of Dargah Shah Arzan neighborhood is a member at this branch. She runs a small eatery near a school in Sultanganj, Patna.

In 2019, she became a member of Al-Khair by depositing Rs 500 per month from her husband’s savings.

“During the countrywide Covid-19 lockdown in March 2020, managing our household expenses became difficult as there was no work,” Parween, a mother of two daughters, told TwoCircles.net. As she was a member of Al-Khair, it only took a week for her to avail a loan of Rs 25,000.

She said she found it easier to repay the loan as the field staff from Al-Khair collected Rs 100-200 every day from her.

The hassle-free loans offered by Al-Khair, which take around two weeks to disburse after submitting basic documents, are popular among low-income groups. Its door-to-door system of collection is also found to be a matter of ease for its members.

Rajesh Sahu, from the Madhubani district of Bihar, is a vegetable vendor in Gomti Nagar, Lucknow in Uttar Pradesh. In 2012, he started his small shop with a loan of Rs 3000 from Al-Khair.

Sahu told TwoCircles.net that he was introduced to Al-Khair by his brother-in-law who was a beneficiary. “There is no hassle with Al-Khair. They don’t ask for too many documents and their charges to disburse loan is reasonable unlike where interest is charged which gets compounded,” he said. He is currently repaying his loan of Rs two lakhs, which he had taken in March this year, by depositing Rs 800 to 1000 every day.

Despite its popularity, Al-Khair is finding it difficult to increase its number of branches. The last branch was opened in 2014 at Jamia Nagar, New Delhi which remains its only branch in the national capital.

Fatmi said they have been waiting for almost five years for approval to open their five new branches, which include three in Bihar and two in Jharkhand. Earlier, the decision to open any new branch under MCMS Act lay with the Board of Society, Government of Bihar but after the demonetisation in 2016, the authority was delegated to Registrar, Co-operative in New Delhi under the Central government.

“Our application is lying with them from 2016. We just hope that it gets approved,” Fatmi said.

Sami Ahmad is a journalist based in Patna, Bihar. He tweets at @samipkb

source: http://www.twocircles.net / TwoCircles.net / Home> Lead Story / by Sami Ahmad, TwoCircles.net / May 26th, 2022